Candi Carrera – The Art of Value Investing – Complete course

The Art Of Value Investing With Fundamental Analysis

Master value investing online: Find top stocks, make smart choices, and build a passive income stream. Enhance your investment skills today!

This course includes:

-

14.5 hours on-demand video

-

25 downloadable resources

-

Access on mobile and TV

-

Full lifetime access

DOWNLOAD

You have to be logged in and our VIP Members to see the Download Links

FREE DOWNLOAD FOR ALL VIP MEMBERS!

What you’ll learn

-

Have a good understanding on how to find good stocks & how to invest into those companies

-

Be able to determine the intrinsic / real value of a company

-

Apply key value investing strategies before investing in the stock market

-

Make better investment choices with your money with the right investment mindset

-

Be able to differentiate between good & bad stocks

-

Develop a stream of passive income with your stocks

-

Evaluate a Company’s profitability with Return on Equity Ratio, Return on Invested Capital & Return on Net Tangible Assets (ROE, ROIC, RONTA)

-

Evaluate a Company’s Price-to-Earnings (P/E) Ratio and other key ratios

-

Determine the capacity of a company to payback debt

-

Have a repeatable investment process

-

Understand how investors like Warren Buffett, Benjamin Graham, Charlie Munger or Peter Lynch became rich & successful

-

Be able to use valuation methods like book value, balance sheet reevaluation, dividend models, discounted cash flow & discounted future earnings models

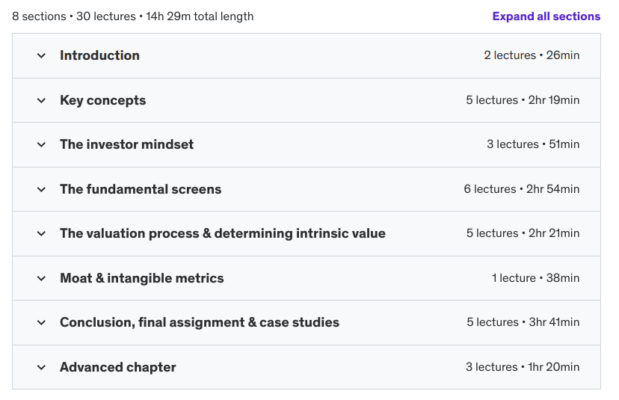

Course content

Requirements

-

Willingness to become a real investor like Warren Buffett, Benjamin Graham or Charlie Munger

-

Having a basic understanding of businesses and how companies work

-

No further prerequisites needed although good to know your long-term investment & wealth goals

Description

This course consolidates 20+ years of experience & learnings as a value investor. You will learn the financial fundamentals of the stock market, money & inflation in order to find great companies at cheap prices. As Warren Buffett said, you do not need a PhD to become a good investor. It requires the mindset of a business owner not a speculator.

This course will teach you how to determine the intrinsic value of a company vs its current share price and also be able to judge if the company has solid financial fundamentals.

UNIQUE CONTENT : In the last part of this course and as part of my own on-going research as a value investor for more than 20 years, I will share with you unique attributes on how to evaluate the moat of companies that only a few investors use and also how to capture customer and employee sentiment about a company.

The purpose of this training is to make you a seasoned investor and develop the right investment mindset while giving you the keys to read company financial statements and growing your wealth. I will teach you the fundamentals how to read financial statements like 10-K, 10-Q reports. After this course you will be equipped with a set of tests to understand the financial strength of a company.

WEBINARS : When subscribing to this training, you are also entitled to join a bi-monthly 2-hour live webinar

Learn the art of value investing and get an edge. Investing in stocks and acting as a business-owner can be a life-changing experience.

Benefit from my 20 years experience as an investor running my own investment fund and rapidly move ahead faster with the knowledge I will share with you.

Many thanks and I appreciate your interest in my course!

– Candi Carrera

RELEASE NOTES :

– August 2023 : added a full valuation example of Stanley Black & Decker (SWK)

– July 2023 : added 2 advanced lectures about dual classes valuation & 2 ratios I sporadically use during investment process. Both advanced lectures are grouped in a specific advanced lectures chapter

– March 2023 : Complete rerecording March/April 2023 update, HQ audio, review of sample companies used in chapter 1 & 2, review of chapter 5, addition of interest coverage ratio next to D/E test

– February 2023 : update of IV calculation sheet

– October 2022 : addition of Appendix 3 – full analysis of Intel Corporation (INTC)

– September 2021 : addition of a 90 minute lecture with complete selection & valuation process

– September 2021 : update of IV calculation file (v2)

– January 2021 : students receive regular invitations to online Webinars/workshops

– December 2020 : addition of Appendix 1 & accompanying valuation file

– November 2020 : addition of 1-pager checklists & wallpapers

Who this course is for:

- People who want to safely invest in the stock market

- People looking for passive income

- People who want to grow their wealth

- People that do not know how to safely invest in the stock market

- People who want to learn the methods of Warren Buffett & Benjamin Graham

- People who want to change their way of living and spend more time with their family, friends & loved ones

DOWNLOAD

You have to be logged in and our VIP Members to see the Download Links

FREE DOWNLOAD FOR ALL VIP MEMBERS!

Related

Be the first to review “Candi Carrera – The Art of Value Investing – Complete course” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.